Exactly how much do i need to acquire which have an effective 100% mortgage?

Before you are acknowledged to have a home loan, a lender will look cautiously at your credit history, your income and you may investing.

Which are the dangers of a beneficial 100% home loan?

The top matter as much as 100% mortgages would be the fact it can boost the risk of negative security. That’s where the value of a property falls, meaning you owe more you reside well worth.

This might cause problems for customers and you will loan providers. This means residents is not able to market and you may finance companies often getting stuck having attributes that are worthy of less than the mortgage increasing the likelihood of a special prospective freeze.

These mortgage loans are far more pricey. Like Skipton’s Background Home loan keeps a fixed rates from 6.19% for 5 decades. The least expensive ninety% LTV 5 season fix is 5.49% of Skipton.

Why does Skipton Strengthening Society’s 100% financial really works and certainly will I have one?

Skipton Building Neighborhood released an excellent 100% financial equipment named an excellent History Mortgage’ in the aimed at clients unable to rescue to possess in initial deposit.

You might acquire out of 95% to help you 100% of the worth of the property around ?600,000, meaning its not necessary to include a deposit for people who should not. It requires the type of an effective four-year repaired-price financial billing annual interest out of 6.19%, without fees to expend.

- Need certainly to either be basic-time buyers with never ever owned a home, or clients that have previously owned a home not while in the the final 3 years

- Old 21 or over

- Have less than just an excellent 5% deposit

- No overlooked payments on costs or borrowing commitments in the last half a year, given that the absolute minimum

- Features proof of that have reduced at the least several months’ lease when you look at the a row in britain, during the last eighteen months

- Features connection with paying all of the domestic debts (elizabeth.grams power bills, council taxation etc.) for around 1 year consecutively, within the last 1 . 5 years

- Maybe not looking to purchase another type of generate flat

Simply how much must i use that have Skipton’s 100% mortgage?

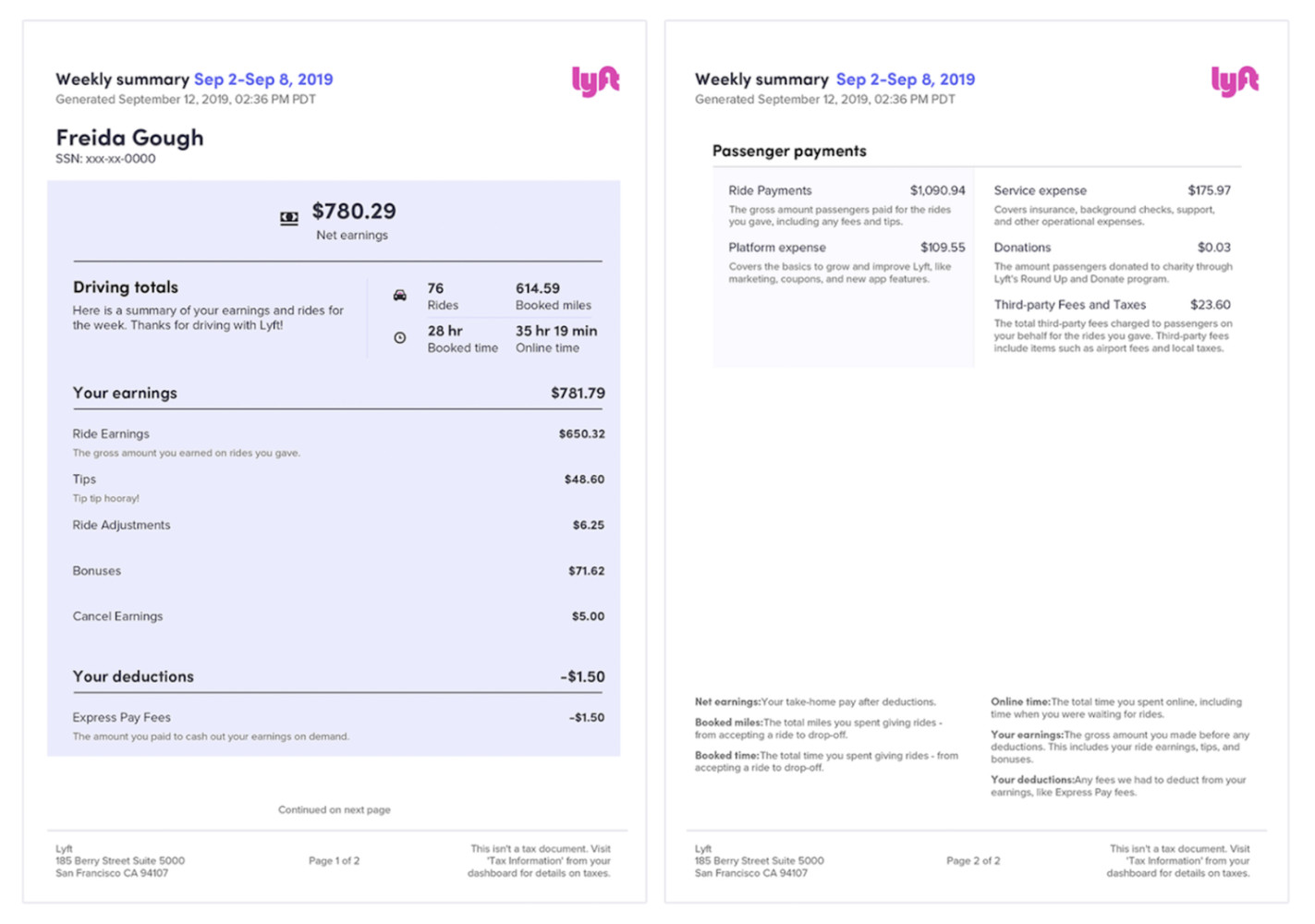

To make sure candidates are able the borrowed funds, Skipton is capping the utmost monthly fees during the its average month-to-month leasing costs during the last six months. So it identifies all round count you could potentially acquire.

Below are various wide variety you might acquire out-of Skipton Building Neighborhood based on more monthly leasing repayments Trinity loans (takes on financing from 100% of one’s property’s well worth with a home loan name of 3 decades):

Are there any additional options online?

Together with the new Skipton device, there are many alternatives available to you currently, but the majority need a cash make certain from a friend or relative, and this functions given that a kind of protection on financial.

Barclays has the benefit of a 100% relatives springboard mortgage and therefore requires the applicant’s partner to put 10% of one’s cost towards the an earnings family savings, that they cannot availability for 5 ages.

Loughborough Building Community allows family relations to put a finances swelling share with the a designated account or invest in deal with a legal fees more their own house, otherwise a variety of the two, through their members of the family deposit mortgage.

For the 2021, government entities along with introduced another type of mortgage ensure plan nevertheless you want in initial deposit to gain access to they. Through the program, the us government guarantees’ 95% mortgages for buyers which have 5% dumps toward land as much as ?600,000.

The latest effort was released within the in order to encourage banking institutions to start offering 95% mortgage loans again, once almost every solitary one to is actually withdrawn inside the pandemic.

Beneath the terms of the mortgage make sure design, the government pledges the fresh part of the home loan over 80% (so, having an effective 95% home loan, the remaining fifteen%). This may voice tricky, but in practice it really function the federal government will partially compensate the lending company if a homeowner non-payments to their costs.

Information

A number of the things marketed are from our very own representative people regarding exactly who we discovered settlement. Once we aim to ability some of the finest products offered, we can’t comment all equipment on the market.

No responses yet