Remember a home loan advisor since your private financial professional. They act for loan providers so you’re able to counsel you from the app and you may closure procedure. Your own financial advisor also known as a brokerage or financing administrator is actually somebody you could consider for your mortgage issues.

1. What kinds of financing do you promote?

Most someone now offers fixed-rates and you may adjustable-price mortgages, nevertheless title, pricing, otherwise special financing choices is minimal based where you stand looking. You need to inquire that it matter basic observe the number away from alternatives provided.

Tip: One of the several great things about dealing with a home loan advisor including Harden try i use a network of over sixty loan providers for the best rates and you may financing for your financial situation.

2. What type of mortgage is the best for me?

Mortgages aren’t that dimensions matches the. Your home loan coach would be to direct you throughout your choice and you will high light the advantages and you can disadvantages of each options. Sooner, they may be able help you decide the best mortgage to suit your disease.

Tip: Someone seeking to persuade you to do the first rate you might be offered without knowing debt profile has no your absolute best hobbies in your mind.

Ask your large financial company about some other down-payment possibilities. The standard advice about protecting 20% to suit your down-payment may not actually be best for you with regards to the form of family you happen to be to purchase, the money you owe, and you may latest rates.

If you opt to put below 20% down, pose a question to your mortgage advisor throughout the private mortgage insurance policies and you will any unique advertising who does allow you to sign up for their home’s equity less.

Tip: Their home loan advisor otherwise broker is a professional about your region’s down payment recommendations programs, so be sure to ask their assist regarding one applications you to can get connect with your situation.

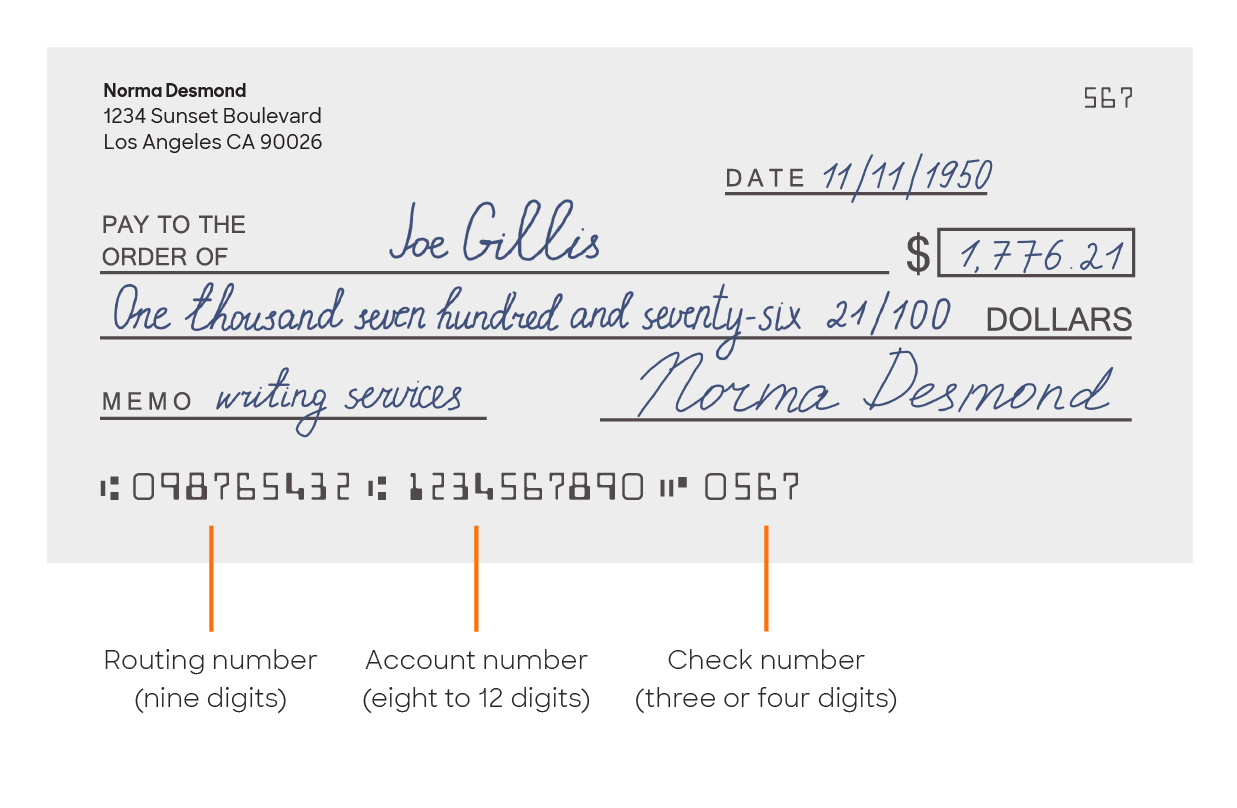

cuatro. What exactly is my loan guess?

A loan estimate reduces most of the expenses associated with the mortgage in addition to one closing costs and an estimate out-of the money necessary at the closing. Loan providers is legitimately necessary to promote that it for you within this about three working days of one’s application for the loan. Consider your financial mentor with questions about whatever does not sound right.

Tip: Three business days ahead of closure, you’ll also receive an ending disclosure, aided by the home loan will cost you and you will third-group fees.

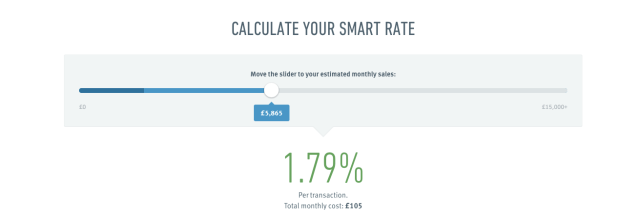

5. What is my personal rate of interest and you will apr?

When you discovered your quote, just remember that , the rate should determine your monthly payment number. The fresh new apr (APR) is the interest including financing fees.

An agent will provide you multiple rates prices from some lenders, providing you with much more choice on your financing options. Understand that if you opt to focus on a great bank’s loan manager, your own rates and you may equipment choices are so much more limited.

While thinking about taking a changeable-rate mortgage, inquire how frequently the interest rate could well be modified in addition to most it might increase.

Tip: While inquiring in the potential cost, know what your month-to-month home percentage will be as really because the the newest Apr so that you learn every embedded charges on the financial.

six. Do you really promote rates locks?

An increase secure claims your own rate will stay a comparable regarding finalizing so you can closing. To preserve a decreased rates, pose a question to your mortgage advisor once they offer interest rate hair. Whenever they would, ask how much cash they can cost you (when the anything), how long they lasts, and in case they give extensions immediately after expiration. Also, check that you should buy the speed protected composing.

Tip: If you choose to get an increase secure, move quickly inside the techniques. If you don’t, you could deal with high priced lock expansion charges.

seven. Will there be a prepayment punishment?

Particular lenders disincentivize individuals paying the finance out of early. Pose a question to your mortgage advisor simply to walk your from the regards to the mortgage and you will discover in the event the you will find one prepayment penalties for paying the loan early or refinancing.

Tip: Prepayment punishment may be repaired figures otherwise calculated in line with the portion of the newest loan’s dominating or left focus.

8. What will cost you can i pay in the closure?

The financial mentor can provide the buck levels of your settlement costs. The average settlement costs to possess a mortgage cover anything from:

Tip: Enquire about financial borrowing from the bank. Within Solidify, 99% of our loans is actually low or no rates that with an excellent financial borrowing to afford closing charge and you can will set you back. To save in your https://paydayloanalabama.com/clayhatchee/ loan costs, get in touch with a good Harden Financial advisor today.

9. Whenever tend to my personal financing personal?

To policy for the circulate, ask your home loan advisor toward loan’s address closure day and you will move-in the times. In addition to query once they render almost any ensure off on the-date closure, to make certain that whether your closure gets pushed back, you will be compensated.

ten. Exactly what ought i do as i wait a little for my mortgage to help you intimate?

One decisions which will majorly impression your credit rating shall be averted as you await the loan records become acknowledged. If there is any borrowing-related interest you’re considering, such as for instance beginning another type of charge card otherwise to shop for seats with the credit, pose a question to your home loan advisor because of their advice before you operate.

Tip: Prevent modifying services or income avenues throughout your mortgage acceptance process, as it could manage changes for the acknowledged financing proportions.

A final Idea

The financial advisor would be men you believe and you can getting safe looking at for your inquiries. If you are searching to get started along with your a home loan, call us and we will let.

No responses yet