Put the collateral in your home to function and you can spend less that have a low-value interest Family Collateral Mortgage or Type of Credit today!

At first Alliance Credit Relationship we provide a predetermined-rates home equity loan or a flexible house guarantee collection of credit (HELOC). One another alternatives enable you to accessibility the collateral of your house so you’re able to purchase many expenses particularly: house restorations programs, training costs, wedding events, scientific costs, and a lot more.

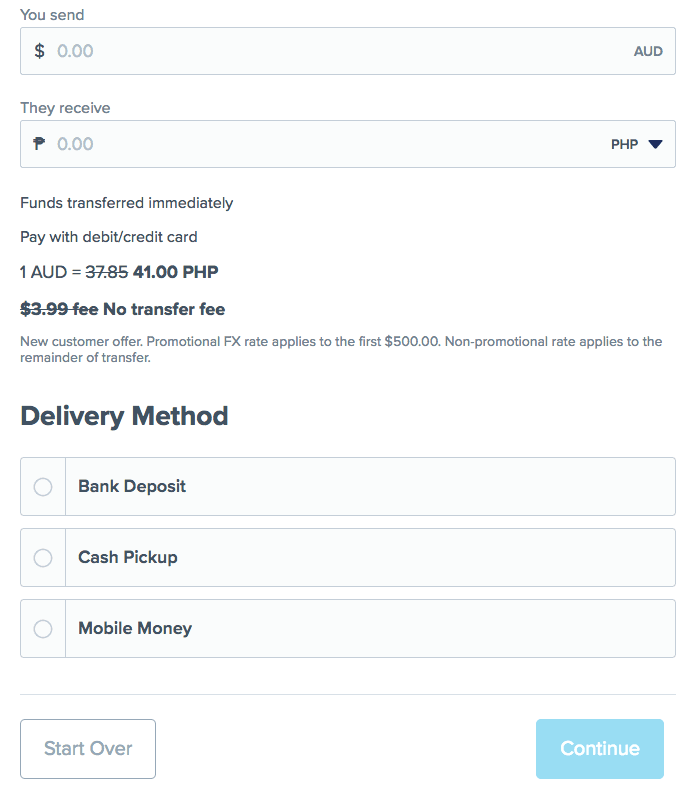

Most recent Domestic Security Prices

Home Security Personal lines of credit and you can House Security Money is covered of the equity on your own no. 1 residence, mostly into the the second lien standing. Rates was modified sporadically and are also at the mercy of changes instead notice along with mortgage terms and conditions. Homeowner’s possessions insurance policy is expected. Ton insurance coverage could be called for predicated on a ton dedication report that try utilized during the duration of software.

Settlement costs tend to connect with House Equity Funds and you can Traces from Credit and vary according to the loan amount. Analogy loan degrees of $ten,000 – $100,000 will have applicable fees between no less than $400 doing $650. These types of fees depend on a standard valuation procedure, if the an assessment is deemed required both of the person in from loan acceptance techniques this type of fees might be enhanced based into fundamental assessment charges. Charge are susceptible to change any moment without notice.

The Apr (APR) having Household Guarantee Credit lines depend on brand new Wall structure Road Journal Finest Speed (Prime) in addition to good margin and certainly will differ having improvement in the prime rates. Annual percentage rate minimum was step 3% having all in all, eleven%. Your own Apr might possibly be determined based on the Prime Rate on time of financing origination plus borrowing qualifications and you can Shared Financing-to-Worthy of (CLTV) toward topic property. Domestic Collateral Personal lines of credit keeps good 10 seasons draw period followed closely by a good 10 season cost several months.

Domestic Equity Personal line of credit percentage could well be step 1% of outstanding loan harmony during the time of payment calculation otherwise $100, any is higher.

Home Security Line of credit (HELOC)

A house Guarantee Line of credit (HELOC) is a fantastic selection for an individual who wants getting the independency to draw loans when they want it and certainly will put it to use for the majority one mission.

- Designed for include in most of your home.

- An unbarred-concluded credit line you might manage using On the web Financial.

- Payment per month change according to the amount you owe.

- The attention you pay tends to be tax-deductible – speak to your income tax agent for more information.

Repaired Rates House Guarantee Mortgage

Instead of a great HELOC, which is a variable speed credit line, a predetermined rate domestic equity mortgage is a closed-end financing with a fixed interest. It’s a really good option when you find yourself likely to generate an excellent higher you to definitely-go out investment, particularly fixing or remodeling your home, or to shop for another house.

- The pace and you can payment per month remain a similar along the lifetime of the loan.

- The interest you only pay are tax deductible (consult your taxation adviser to find out more).

Family Equity Financing Faq’s

Manage house guarantee loans need an advance payment? Zero! Home collateral loans don’t require a downpayment, when you are making use of the collateral of your property just like the collateral. Yet not, you will find usually settlement costs or any other charges reviewed to have home collateral financing. Your own financial often bad credit loans Fairfield University CT discuss these types of more costs for your unique disease prior to your loan shuts.

How much from my personal home’s collateral do i need to have fun with for my personal loan? We advice remaining the borrowed funds-to-value proportion lower than 90%. For example, whether your available security try $100,000, we could possibly highly recommend playing with no more than $ninety,000 to cover your loan’s collateral. But not, each person’s condition is different or other situations ount regarding security you’re able to accessibility for your financing. It’s best to speak with the credit class and you will speak about their particular problem.

How long really does the loan application techniques grab? It varies depending on your specific disease. Typically, in the event the no appraisal will become necessary, it takes about 14 days. In the event that an assessment becomes necessary, then the procedure takes expanded, perhaps around monthly. The lenders could keep your high tech into improvements of one’s assessment and your household security loan.

Where does our home equity financing romantic? A house equity loan otherwise line of credit shuts in our department practices. Their bank are working to you to determine the best go out and you may destination to complete the loan closing.

No responses yet