The Federal Homes Administration and you may Congress wanted to raise Ca FHA mortgage limits to own 2024. This is exactly very good news to have prospects looking to buy a property and homeowners picking out the opportunity to re-finance their home loan for the an excellent financing on a lower rate of interest. BD All over the country allows you to understand the 2024 Ca FHA financing restrictions on the part throughout the Wonderful Suggest that you are felt to order a house during the.

Simply how much Do you need to Borrow?

Because s, the application of FHA mortgage loans have raised now these finance are extremely popular in the country.

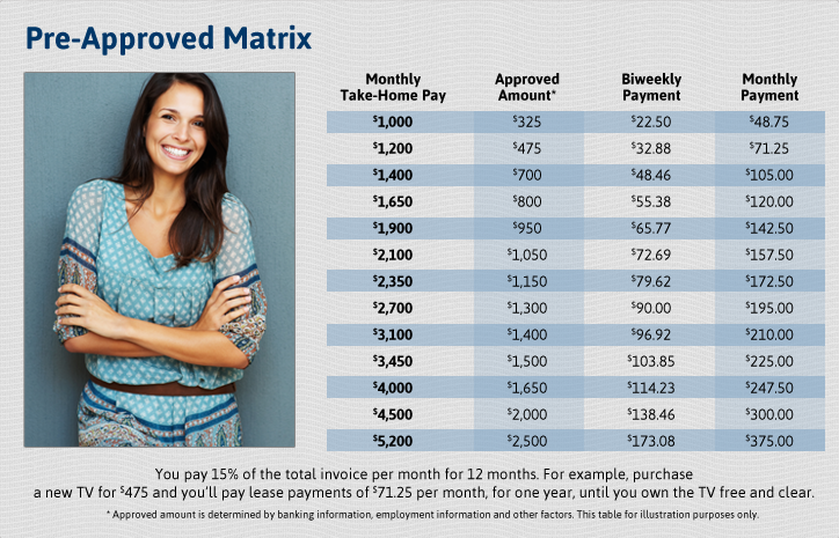

There are lots of aspects of one, but it comes down to the reality that having first go out homebuyers and for individuals with low credit scores, FHA resource is certainly one the best so you’re able to qualify for and gives the very best words readily available. BD Nationwide will help you comprehend the California mortgage constraints while bringing a pre-approval page to have a beneficial FHA mortgage.

FHA Financing Restriction for the Ca to own 2024

Let’s remark new inform 2024 FHA Loan Numbers having Ca. By way of example, areas particularly San francisco, La, Oakland, Berkeley, Santa Cruz, Long Beach, Anaheim, San Jose, Santa Clara, Watsonville, and you will Sunnyvale brag the highest FHA mortgage restrictions during the Ca. These types of FHA home loan limitations California is actually $1,149,825 to possess solitary-members of the family homes, $1,472,250 for a couple of-family homes, $step one,779,525 for three-household members homes, and $2,211,600 to have five-nearest and dearest home.

- High FHA maximum amount borrowed Ca

- Updated California FHA financing constraints 2024

How much Must i Acquire that have FHA into the Ca?

Although not, there’s been particular concern lately about what loan limitations associated with the them. On 2024 year, industry experts agree your proven fact that Ca FHA financing limitations commonly gonna alter isn’t really a detrimental point. New FHA maximum amount borrowed to possess California changes a year when Congress set the new limitations.

And because one other question is changing out-of FHA loans, they’ll nevertheless be easier to be eligible for and additionally be an sophisticated option for whoever is not able to secure a far more traditional financing, sometimes because of insufficient a huge down-payment or due to a less than perfect FICO rating.

Inside California, urban centers including Bay area, La, Oakland, Berkeley, Santa Cruz, A lot of time Coastline, Anaheim, San Jose, Santa Clara, Watsonville, and you can Sunnyvale feature the greatest FHA mortgage restrictions. Maximum financing wide variety height within $step one,149,825 getting solitary-members of the family homes, $1,472,250 for a couple of-family unit members homes, $step one,779,525 for a few-family members homes, and $dos,211,600 for four-friends characteristics.

Ca has the benefit of a plethora of homebuyer direction programs, for every along with its very own number of qualification conditions. They drops toward borrower so you’re able to carry out look in these programs and you may enhance with these people physically, independent off their bank.

Ca FHA Financial Restrictions

Ca loan limitations will vary based on where exactly you reside. Into the densely inhabited metro places where prices are very high, mortgage constraints have a tendency to finally score a boost.

For those shopping for a property from inside the outlying components or those in which construction costs are down, the borrowed funds limitation also will still be the same getting 2024, during the $271,050.

Particularly, to own 2024 this new annual insurance premiums in the FHA funds are browsing lose from 1.thirty five down seriously to .85.

If this was in addition to today’s dramatically reduced interest levels of below 4 % most of the time, it means one the latest FHA financing gives particular most generous discount.

And people who need to refinance due to FHA loans Colorado City CO applications usually additionally be able to get faster costs thanks to this type of the alter.

Luckily for us, the latest land on age pricing these were in most of 2023 too. This means that people who are trying to find a house usually have absolutely nothing issues wanting one which drops during the constraints away from an enthusiastic FHA mortgage, which makes it easier to keep the mortgage that you should get into the place to find your own fantasies.

No responses yet