Revelation statement

Stuart Snaith can not work for, request, individual offers during the otherwise discovered money off any organization or organization who make use of this article, and it has unveiled no related associations beyond their educational meeting.

Partners

Within the a quote to handle Canada’s construction drama, Deputy Prime Minister and you may Money Minister Chrystia Freeland announced the newest change in order to home loan statutes to the Sept. sixteen, set-to begin working inside December, geared towards while making property more affordable.

The first major changes try an increase in the cost cover having covered mortgage loans, raising it in order to $step 1.5 billion of $1 million.

For the Canada, when the potential home buyers have less than a 20 % deposit, he’s needed to provides standard insurance rates. Mortgage insurance rates protects lenders against standard and helps people get residential property which have as little as five per cent deposit. Before announcement, insurance rates only has been designed for house priced at $one million or less.

Next transform ‘s the expansion out of amortization symptoms. Until this present year, people just who expected standard insurance on their mortgages was in fact simply for a 25-year amortization months.

During the August, it was relaxed to allow basic-big date buyers to order freshly built homes that have a 30-year amortization. It has got now become longer to allow basic-go out customers to find people family. On top of that, individuals trying to pick another generate is now able to make use of a thirty-12 months mortgage.

Freeland advised reporters the alterations often place the imagine home ownership when you look at the grab even more young Canadians. But exactly how most likely are these change and come up with home ownership even more achievable for Canadians who much more view it because the a faraway dream?

Drawbacks to remember

For every element of which statement increase buyers’ power to buy property. Way more customers will be able to access 29-year mortgage loans, and that happens hand-in-hand having lower home loan repayments. On the other hand, a lot of Canadian homes inventory might payday loan Cripple Creek be into the price cap for covered mortgages.

not, despite such changes, cost stays a problem. Regarding the increased rate cover, Canadians still have to manage to spend the money for financial into the the original put. Since the few Canadians are able home financing of over an effective million bucks, the perception of one’s 30-season mortgages are the more significant of your own one or two actions.

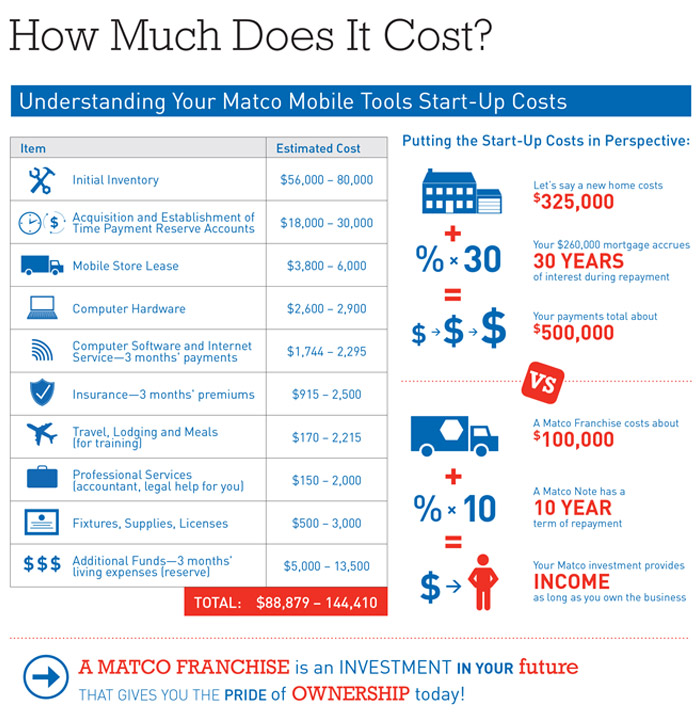

Regarding 31-year mortgages, whenever you are repayments could well be quicker, way more interest would-be paid off across the longevity of the mortgage. Believe a loan out of $700,000. That have a twenty five-seasons mortgage during the five per cent, the brand new month-to-month financial cost could well be $cuatro,071 (ignoring the expense of default insurance). Which have a thirty-12 months financial for a passing fancy foundation, so it falls in order to $3,736. Although not, it is sold with an approximate 24 percent escalation in desire paid back across the lifetime of the loan.

Another important aspect to consider would be the fact Canada already comes with the high domestic loans in order to disposable income on G7. Where do the majority of that it personal debt are from? Mortgages.

An excellent 2023 report from the Canada Home loan and you can Casing Firm located you to 75 % regarding Canada’s home financial obligation arises from mortgages. Such highest amounts of loans is also inflict extreme destroy throughout the moments regarding economic crisis.

Definitely, huge mortgage loans mode far more debt. Because the brand new home loan rules are designed to offer consumers a great deal more independency, the long-title effect off big finance toward domestic obligations while the broad savings is still around seen.

4 million house by 2031

If you find yourself these the new changes will be trigger demand, particularly for new-makes, Freeland thinks new demand these types of steps create have a tendency to incentivize even more the housing structure and you may handle the new property lack. This type of change are part of the government’s services to get to know its goal of making almost four mil the newest property by the 2031.

The fresh government’s capability to ensure this type of the brand new property manufactured will become key to making certain these the fresh new home loan statutes deliver on their guarantee of fabricating homes inexpensive.

In the lack of enhanced likewise have, the chance was this type of alter could result in highest prices, especially just like the Financial away from Canada continues to slashed interest rates and you may given this week Canada’s rising cost of living speed finally hit the Lender out-of Canada’s target. In fact a recently available statement because of the Desjardins cautions one increasing the duration away from mortgages you may get worse value.

Over the second pair home, this new interplay between speed falls, brand new financial regulations as well as other federal efforts to address housing have will have to be saw closely. And also make matters a great deal more fascinating, the potential for an early election can result in a choice method to property value considering current polling suggesting Pierre Poilievre’s Conventional Class you can expect to more than likely setting the next most authorities.

No responses yet