- NIVA No-Income, Verified-Property finance were used to own applicants whose money cannot feel confirmed.

- NINA No-Money, No-House finance feel the fewest standards of all the and you can were implied getting individuals who cannot show possibly income otherwise present assets.

Today, no-doc mortgages would-be a choice as long as you are talking in order to loan providers who aren’t held so you’re able to licensed home loan legislation of the bodies companies (such as Federal national mortgage association or Freddie Mac computer). That means potential real estate buyers would need to approach lead loan providers, wholesale lenders, and enormous expense agencies so you’re able to probably secure-contained in this types of mortgage.

The majority of people work at earnings and you may FICO rating, but having the lowest DTI can be the determining reason behind whether your qualify for a no earnings home loan otherwise one mortgage, for instance.

A decreased DTI shows that you may have a good balance between personal debt and you may money. Instance, when you yourself have a great DTI of 20%, because of this 20% of your own terrible monthly earnings goes to provider loans.

At the same time, if you have an effective DTI regarding forty five%, it indicates forty-five% of one’s monthly money was using debt, and therefore some lenders can find given that excessive to own financing approval.

Most consumers to have a no-money home loan that have a minimal DTI will do their loans repayments more effectively than some body with a high DTI. Thanks to this most no-earnings lenders want to see good DTI that meets from inside the the variables just before mortgage approval.

This will make sense; the lending company desires to ensure new borrower isn’t overextended. This will be twice as happening and no-money mortgages the spot where the borrower does not have any an identical proof income as individuals delivering a normal financial.

Just how high of an effective DTI you can have to get recognized getting a zero-earnings home loan utilizes the lender. However, of several lenders say the best DTI you can have and be approved to own home financing are 43%.

However, extremely lenders like to see a reduced DTI under 36% when possible. Consumers with a reduced DTI have a tendency to qualify for the best notice pricing and low off repayments.

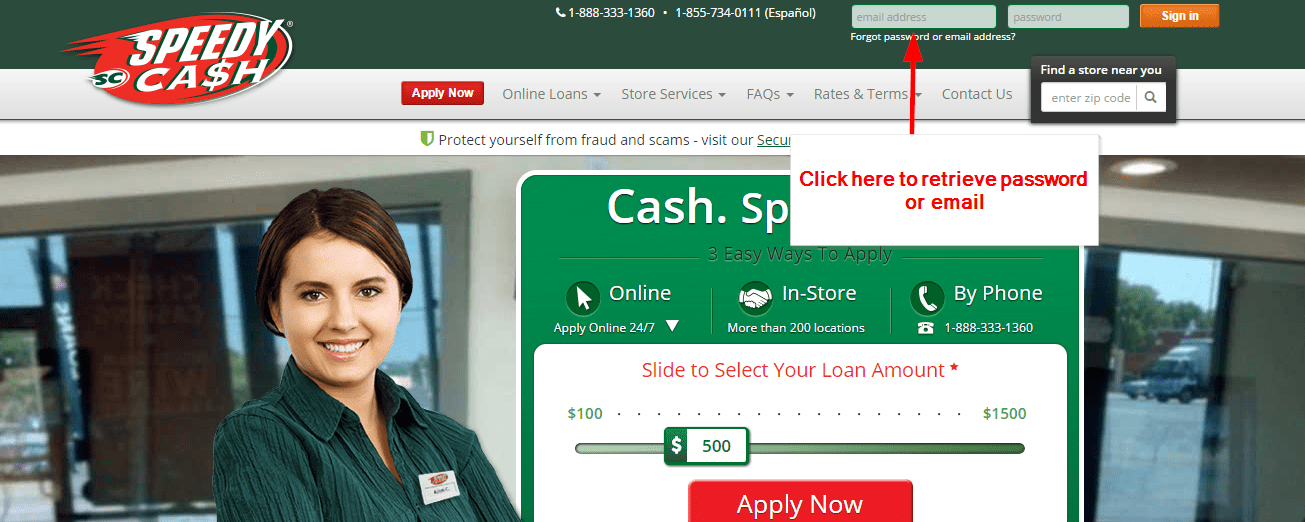

Speak to your financial today to find out http://speedycashloan.net/loans/tribal-installment-loans/ if a stated money financial is an excellent complement your financial needs

Lenders including want to see that the use was investing no more than 28% of the disgusting monthly income due to their homeloan payment.

If the DTI is simply too high for one lender, there are a few possibilities. Basic, just be sure to decrease your debt-to-income proportion. This can be done if you are paying regarding as often financial obligation while the you might before you apply for a home loan.

Second, you will need to increase your money or put a separate debtor toward app. Another option in case the DTI is just too higher is to simply find an alternative financial. Certain mentioned money lenders assists you to has actually a high DTI as opposed to others.

The very last choice is to get more funds down; certain loan providers usually okay the borrowed funds with high DTI for those who have a high down-payment. Consider, you always need to have an effective DTI off no more than 43% when you need to getting accepted to own a no-money financial. However, consult with your financial since their standards may differ.

Mentioned Money Financing Conclusion

Said money mortgages are a good way for individuals into the non-antique types of a position to obtain a home loan. Said income mortgage loans are a great selection for borrowers which never confirm the income having taxation information, W-2s, and you will spend stubs. New RefiGuide is also point you in the correct guidelines to meet up with high risk mortgage lenders, you must determine if this new mentioned income mortgage loans is actually really worth the exposure and better attract raes.

That have mentioned money mortgage loans, you borrow cash up against the property. The total amount you are allowed for the loan, known as borrowing ft, is determined based on a percentage of your own assets’ worthy of. An asset qualification financing makes you play with 70% out of what you provides in retirement and you may financial support account and 100% of quick assets, such as the value of your own bank accounts.

- SIVA Stated-money, Verified-Assets finance. Generally, applicants generated a list of their possessions to own stated earnings mortgage lenders put as cause for loan recognition. They have already also been termed bank report loans.

No responses yet