Passive Backup

Which claims that the house Consumer features a specified quantity of weeks to apply for and secure a firm loan connection out of a lender or any other type of bank one that has been fully underwritten. (This isn’t an effective pre-recognition as an alternative, this is when the loan underwriting process has had place.)

In the event the Client is preferable to the credit due date rather than terminating new contract otherwise asking for an expansion (that your vendor must agree to on paper), then the Customer has automatically waived brand new backup, meaning the buyer enjoys purchased creating most of the financing expected to acquire our home, whether or not the loan was in the course of time acknowledged or not. In such a case, since the a buyer, you would have to seriously consider the fresh new calendar and you will make sure you are relying the times properly.

Active Contingency

The brand new active backup is the next most frequent particular money contingency that’s a bit more tricky and you will leaves a lot more of the duty through to our home merchant.

In this scenario, the financing backup addendum claims that the Provider comes with the right to help you terminate, but just just after a consented-upon number of months entry and simply once helping notice to the buyer that merchant may love to cancel the latest bargain at any time after delivery out-of instance observe.

In the event the Vendor will not serve so it observe following the specified level of months regarding backup, the financing contingency survives from remainder of the sales processes. Think about this potential find such as the Supplier are waving their palms and you can asking, Hi… what’s up together with your financial support?

In case your domestic client provides put up to finance and also been fully underwritten, then the client should fulfill the money contingency within that time fully. In the event that, but not, the customer does little after finding it find, then they has reached chance of our home seller terminating the new price at any time.

Since most fund commonly totally underwritten until prior to closure, very people will not volunteer to waive the credit contingency because if for example the investment goes wrong, they’re going to be subject to the new forfeiture from earnest money. Proceed cautiously is always to so it scenario happen to you.

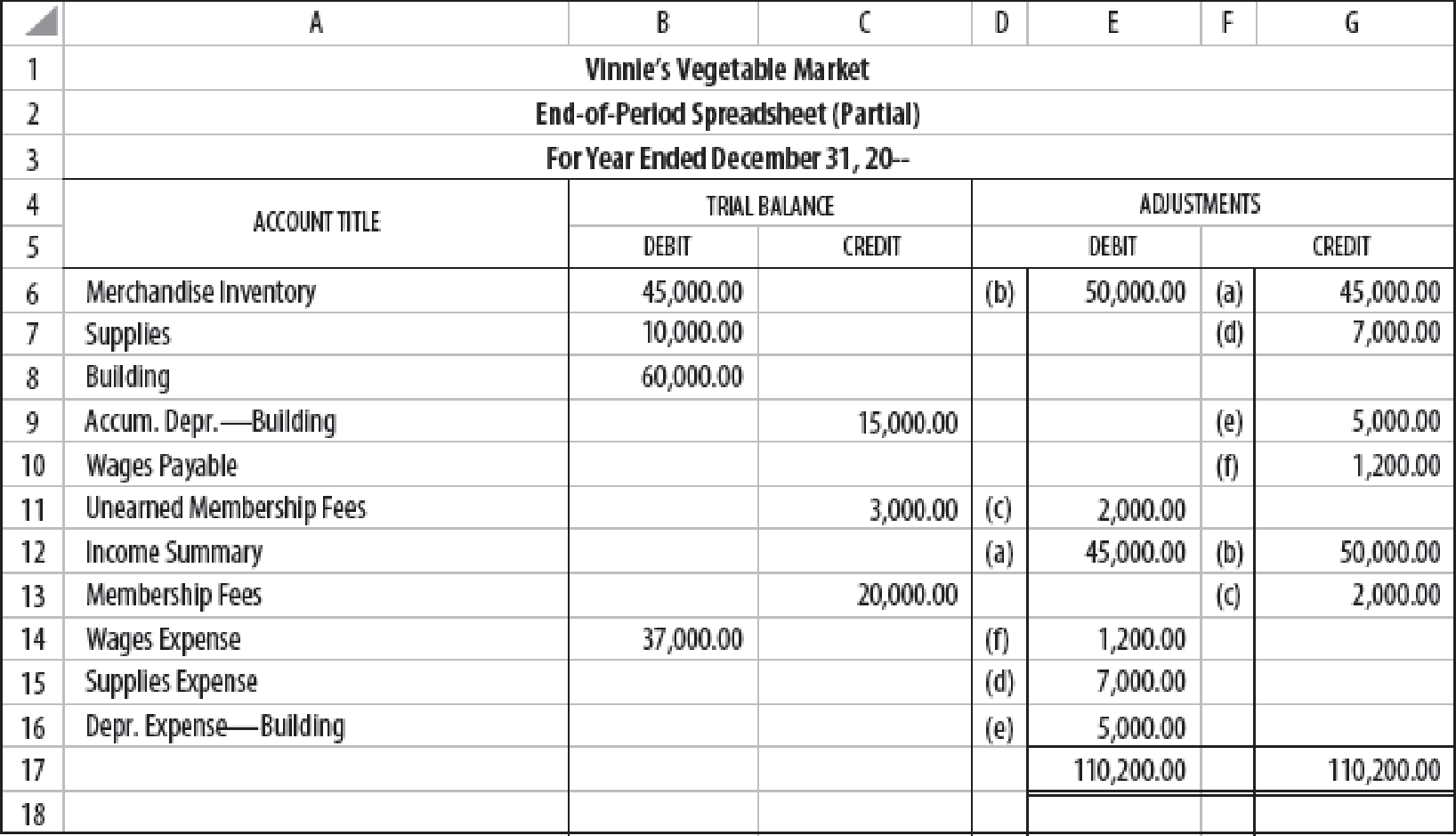

Understanding the subtleties out-of resource contingencies is extremely important whenever navigating the brand new complexities out of a home transactions. The following desk depicts some uses out-of investment contingencies in addition to positives and negatives each and every. This information is enable customers and providers to make informed choices, making certain the appeal are covered regarding deal techniques.

Why would You N’t have a money Contingency?

For those who have no goal of providing resource inside a specific schedule, it may not getting needed to are a financing backup during the your own bring. For example, when you need to pay for the total marketing cost of your brand-new house with dollars, its not necessary a fund contingency as little closes you out of purchasing the property downright. But not, if you intend to make use of a traditional financial to invest in the new pick, together with a financing backup on the bargain are a good idea.

One other reason to waive the credit backup could be if you find yourself inside a competitive housing market bidding facing other potential residents.

From inside the an aggressive marketplace in which multiple now offers are required, suppliers often prefer has the benefit of to the high money number, most powerful money conditions, and you can fewest standards and stipulations. And make its render a whole lot more competitive, some people may decide to fill in a non-contingent render because of the waiving its liberties to all sort of contingencies, for instance the assessment contingency and you will inspection contingency. Performing this manage obviously set you lower than particular number of monetary chance, and you may more than likely forfeit loans Mosses people serious currency when it features been reduced on provider.

No responses yet