The newest FHA (Government Construction Government) financing is a wonderful way for Illinois owners to purchase good household. Whether you’re buying your basic house or six th house, getting an enthusiastic FHA loan makes it possible to get to homeownership which have several advantages.

Illinois FHA Loans Promote Lenient Credit Requirements

Typically, the credit requirements for getting an FHA loan into the Illinois try less strict compared to old-fashioned loan regulations. This enables people with limited credit rating, if you don’t certain prior imperfections, so you can be eligible for an FHA mortgage. If you’re a conventional mortgage loan will often require the absolute minimum borrowing rating requirement of 740 or higher in order to qualify for a knowledgeable terms and conditions, FHA home loans will likely be accepted having millions of five hundred or more than.

On the sight of FHA, 1st part of somebody’s credit score is the current several-day mortgage repayment record. If for example the last one year demonstrate that loans Millerville an individual may see each of their personal debt promptly rather than resorting to borrowing from the bank so much more currency, that’s constantly an indication the person is willing to deal with homeownership.

Earnings Paperwork

Since the authorities protected brand new FHA mortgage program, we offer a good display from documentation criteria. For many who receive a beneficial W-dos function on a yearly basis, the ensuing list represents just what will be needed people in order to prove your earnings

- Your income stubs out of your company. You must have spend stubs layer no less than the past 29 schedule weeks. Even more paystubs would be expected based on how far out this new closure big date is.

- Their W-dos variations out of at the least for the last 2 years

- Their federal income tax production for the past 24 months having most of the times

- Your own federal taxation statements for the past couple of years

- Your company’s federal tax returns the past 24 months

- Profit-and-loss statement throughout the 1 st of the year from app big date

Dependent on your unique state the loan manager can get want to know to find out more. Be ready to timely let you know any of your financial files so you’re able to the borrowed funds bank to save the loan procedure moving together.

Besides proving the actual income, the lending company usually make sure work to ensure you have been constantly used for the last 2 yrs. Even though it is ok to evolve work, make sure that you try maximizing on your own with a brand new workplace hence there are no unexplained holes on your own work checklist.

Top Home Merely

The newest Illinois FHA mortgage is designed for people who tend to live-in your house as his or her number 1 house. FHA doesn’t financing money having vacation homes otherwise leasing services.

Yet not, new FHA system is actually flexible concerning type of property you to definitely you get. If you are an adhere-created, single-house is among the most prominent assets financed due to an enthusiastic FHA-insured home loan, there are more kind of qualities eligible for resource. The ensuing list shows the sort of residential property one to FHA often imagine capital:

- Single-house

- Duplex (you must are now living in that area. You could potentially book one other point)

- Three-equipment (you should inhabit you to area. You might rent out the other areas)

If you’re a condo is going to be approved to possess FHA capital, it entails a tad bit more documents. Based be it a recently developed condo otherwise a great pre-established condo often determine hence assistance must be found. Your FHA financial is take you step-by-step through these guidelines that assist your determine if the condominium is approved to have an enthusiastic FHA mortgage mortgage.

Documenting Your Advance payment

The new FHA guidelines state that a guy to order a home into the Illinois need to pay no less than a little down-payment off 3.5 percent of house’s price since a deposit. It means, such as, that a person to purchase property in Illinois coming in at $two hundred,000 would need to shell out $eight,000 within closure towards deposit.

FHA has a good element that will help a lot of first-day homebuyers in the Illinois. The cash employed for the latest deposit should be something special from a close relative otherwise companion. Toward provide getting desired, both you and the newest relative will have to establish copies of bank account. Good sixty-date report walk appearing where in actuality the money was withdrawn out-of and you can transferred are expected. You should in addition to establish a brief letter discussing that the money is actually a present rather than anticipated to getting paid back.

Non-Occupying Co-Borrower can be found As well!

You to product one to generally seems to stop folks from purchasing property is their debt-to-earnings proportion. For 1 cause or another, a man seemingly have an excessive amount of obligations written down so you can be considered an effective exposure to possess a home loan. The latest non-consuming co-borrower alternative support beat that it burden.

FHA allows one to co-sign up a mortgage instead demanding the person to reside the house. This allows a member of family with a very good money to simply help out a younger relative within their quest to shop for a house.

FHA enable it circumstance as long as there can be a direct family unit members loved ones on it. Extremely instances involve a grandfather or grandparent enabling out their child otherwise granddaughter. Siblings may also be helpful almost every other siblings.

As long as the main individuals additionally the non-occupying co-borrowers meet the credit guidelines and you will personal debt-to-income percentages as a combined group, there has to be no issue obtaining financing recognized.

2024 FHA Financing Constraints inside the Illinois

There are upper limitations to have Illinois home buyers with the limitation loan amount available for FHA finance. Home costing or beneath the limitations can be entitled to resource. Certain specified areas of the county once had highest mortgage limits due to the overall financial health of your own area. Yet not, this season there aren’t any high restrictions getting 2024 in almost any of the counties within the Illinois.

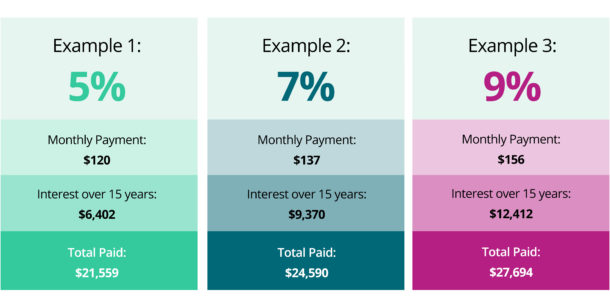

*3.5% deposit considering $193,000, cuatro.125% / 5.713% Annual percentage rate, 30-season fixed rate of interest mortgage. Individual Home loan insurance is required. Costs is actually subject to transform. Subject to borrowing from the bank acceptance.

No responses yet